iowa capital gains tax on property

Enter 100 of any capital gain or loss as reported on federal form 1040 line 6. Capital GAINS Tax.

House Democrats Propose Raising Corporate Capital Gains Tax Rates Pensions Investments

Gains from the sale of stocks or bonds DO NOT qualify for the deduction with the following exception.

. First the administration wanted to impose the capital gains tax only when the heir sold the property. For example lets say you purchased a. Its a federal tax thats paid to the IRS.

You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of property thats not your home for example. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. To claim a deduction for capital gains from the qualifying sale.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. Capital Gain Deduction The capital gain deduction is not to be taken on this line. See Tax Case Study.

The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. How are capital gains taxed in Iowa.

Iowa is a somewhat different story. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Effective with tax year 2012 50 of the gain from the saleexchange of employer. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Toll Free 8773731031 Fax 8777797427.

A capital loss occurs when you sell a property for less money than you originally purchased it for. When a landowner dies the basis is automatically reset. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or.

The 15 rate applies to individual earners between 40401 and. Commercial real estate is a capital asset which. Long-term capital gains tax rate.

Iowa has a unique state tax break for a limited set of capital gains. Short-term capital gains are taxed as ordinary income according to federal. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. For purposes of taxation of capital gains from the sale of real property of a business by a taxpayer there is no waiver of the ten-year material. In some cases you might be able to use a capital loss to reduce your income.

A gain sometimes referred to as a gain on sale is the difference between the sales price of a property and its cost basis. In real estate capital gains tax is the tax you pay on a capital gain made when you sell a property. So in Feenstras example the son or daughter wouldnt have to pay taxes.

Sale to a lineal descendant. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898.

What Changes Are Coming To The Iowa Tax Landscape And When

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

Capital Gains Tax Calculator Estimate What You Ll Owe

An Overview Of Capital Gains Taxes Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

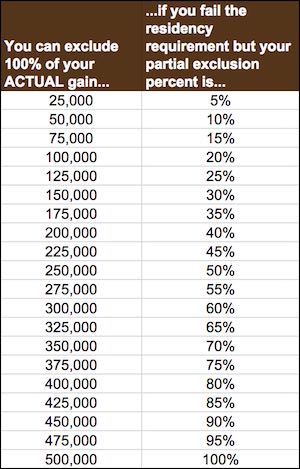

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

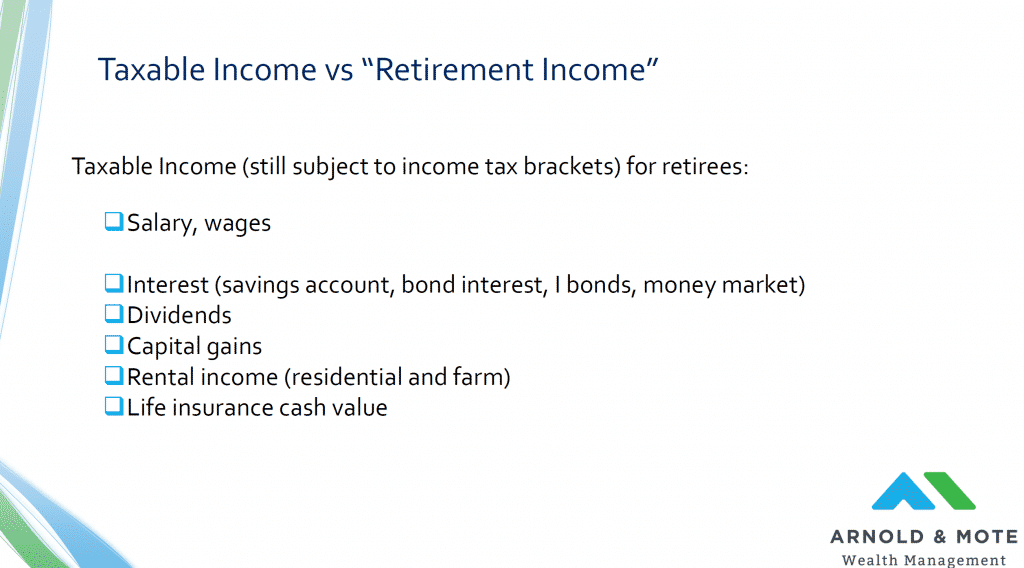

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Iowa Landowner Options

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax On Real Estate And Home Sales

What S In The Iowa Tax Reform Package Tax Foundation

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain